Many people often need clarification about the principles and landscape between chit funds and mutual funds. Both schemes involve pooling money but serve different purposes, leading to misunderstandings.

A mutual fund is an investment scheme that seeks capital appreciation by diversifying its investments across a wide range of assets and securities. While chit funds primarily rely on participant contributions and a lump sum payment.

A common misunderstanding among the people is that these two schemes are seen as investment options. Individuals frequently believe that the entire sum combined in the chit fund can be refunded as a profit. This misconception is due to the lack of clarity people have about the chit-funds, particularly due to the lack of practice on chit-fund plans, which is because of the rise of fraudulent activities over the past few decades. However, genuine chit-fund schemes, such as registered chit-fund plans, have shown promising outputs.

Meanwhile, mutual fund plans became highly popular among investors due to their reliability, authenticity, and potential returns. Mutual fund popularity increases the demand for mutual fund education, reducing confusion about mutual fund plans.

Therefore, we have drafted this “Difference between Chit Funds and Mutual Funds” article to help you understand the core differences between these two plans. In addition to this, we will provide more clarification about these two financial choices that will help you make informed decisions based on your financial goals.

Knowing about chit and mutual funds is highly important when you plan to pool your money in either of these financial instruments. Chit funds and mutual funds are ideal solutions to get a certain amount of money in return by pooling a fixed amount every predetermined time. Both of these financial instruments involve the contribution of money for a certain period. But these two financial plans work differently. Keep reading to understand the principles and nature of these two plans.

Chit funds are savings plans that allow participants to save money and borrow from the scheme. It involves a group of people participating together to make it work. A chit-fund plan works when a group of participants comes together and contributes a fixed amount of money for months or a year.

Then, every month, a winner is selected based on the lottery or auction. The winner receives a lump sum amount, and this process of contribution and selecting a winner is repeated until every member of the chit-fund plans receives money.

Let’s start with an example to get a more detailed insight into the working mechanism of the chit fund.

Let’s assume a group of 10 members decided to start a chit-fund investment by contributing Rs. 20,000 each month. The maturity of the chit fund is set to 20 months.

In the first month,

Total contribution = 20,000 * 10 = Rs. 2,00,000

The organiser conducts an auction to select the winner. For example, let’s say Member A bids a discount of Rs. 6,000 on the total contribution, Member B bids a discount of Rs. 8,000, and so on. Let’s say that Member B wins the auction.

Then, Member B would receive = Rs. 2,00,000 – Rs. 8,000 = Rs. 1,92,000

The remaining Rs. 8,000 would be distributed among the participants.

This process continues until all the participants are selected as winners. Member B will not be eligible for the auction in the remaining rounds. But he or she must contribute without fail.

A mutual fund is a professionally managed investment vehicle that allows investors to place their money in a portfolio of stocks, securities, bonds, and other assets. In a mutual fund, investors are not required to manage the investment portfolio because it is entirely managed by professionals.

Fund managers in mutual fund plans personally track and regulate the mutual fund portfolio of investors based on market conditions. Unlike chit-fund plans, mutual fund plans are subjected to market risks, so they need to be regulated to generate a potential income from the growth of the corresponding stocks and other assets.

After a thorough understanding of chit funds and mutual funds, it is clear that a mutual fund is an investment strategy that guarantees a potential income. Meanwhile, a chit fund is a savings plan in which participants receive a lump sum payment that can be used for any purpose.

Now that you have a clear understanding of how chit funds work, let’s find out how mutual funds work as well.

A mutual fund is an investment plan that allows inventors to contribute to their desired pool of stocks, bonds, and other securities. Investors have the option to invest in either a single lump sum investment or in a systematic investment plan.

Mutual funds schemes are often represented by expected profits in returns. If the invested stocks run well in the predetermined period, then the investors can get the predicted returns. However, if the invested stocks perform poorly, then you may experience significant losses.

Therefore, it is crucial to monitor and track your mutual fund portfolio.

There are numerous chit-fund and mutual fund plans. Chit funds are classified into several types based on their need, purpose, organisation, and regulation. Similarly, mutual fund plans are also diversified into various plans according to various factors, including investment objectives, asset allocation, structure, management style, and risk profile.

Let us look at the various types of chit funds and mutual fund plans that are available to investors.

As the name suggests, it is a highly organised plan that requires weekly or monthly meetings. In the event of distribution, the chit fund manager writes the names of the subscribers on a piece of paper and puts them into a box, where the group leader randomly draws a slip from the box during each meeting, and the person with the name on the slip is considered the winner, and he or she receives the full pooled fund. The winner is required to continue the contribution of the money and attend meetings.

Online chit funds are similar to any other chit fund except meetings and auctions are held online. Online chit-funds began with the emergence of technology. In this, auctions and meetings are held digitally, where payment and contributions are made through online payments.

Registered Chit funds are those chit funds that are registered with the Registrar of Societies of Chits and are regulated by the Reserve Bank of India under the Chit Fund Act of 1982. Registered chit-funds are more reliable than other types of chit-funds because they are regulated by the government. It works similarly to any other chit fund, except it is managed and distributed by a trusted financial organisation.

Unregistered chit funds are those forms of chit funds that are not registered under any government entities. These forms of chit funds are particularly held among family members, close friends, or colleagues. This form of chit fund has so many loopholes and higher risk. Participating in unregistered chit-funds organised by outsiders can be highly risky due to potential defaults from other participants.

Equity mutual funds are pools of stocks in which fund managers invest their money. Fund managers invest in well-established companies that are large-cap, mid-cap, and small-cap. Equity mutual fund schemes require investors to invest more than half of the scheme assets in equities and equity-related instruments.

Debt mutual funds are mutual fund schemes that invest in fixed-income instruments such as government and corporate bonds and corporate debt securities. Debt mutual funds are less risky than equity mutual funds. It also delivers better returns as compared to traditional savings plans.

Hybrid mutual funds invest in multiple asset classes, such as a mix of equity and debt. Hybrid mutual funds are particularly focused on asset diversification. Hybrid mutual funds enable investors to benefit from all asset classes by investing in lower-risk securities, which often provide higher returns.

Money market mutual fund is a kind of mutual fund that invests in high-quality, short-term, and low-risk debt funds that have short maturity periods. Money Market funds are easily accessible, making it an ideal solution for those looking for short-term funding needs.

| Mutual Funds | Chit Funds | |

|---|---|---|

| Objective | Investment | Savings and borrowing |

| Management | Managed by professional fund managers | Supervised by chit-fund companies or organisers |

| Investment strategy | Invest in financial assets | Group saving by pooling money |

| Diversification | Expanded diversification | Limited diversification |

| Risk | Low risk | It can be riskier if the chit-fund plan is not properly managed |

| Liquidity | High liquidity | Less liquidity |

| Regulation | Strictly regulated by SEBI | Registered and non-registered chit funds |

| Transparency | Highly transparent | Highly transparent |

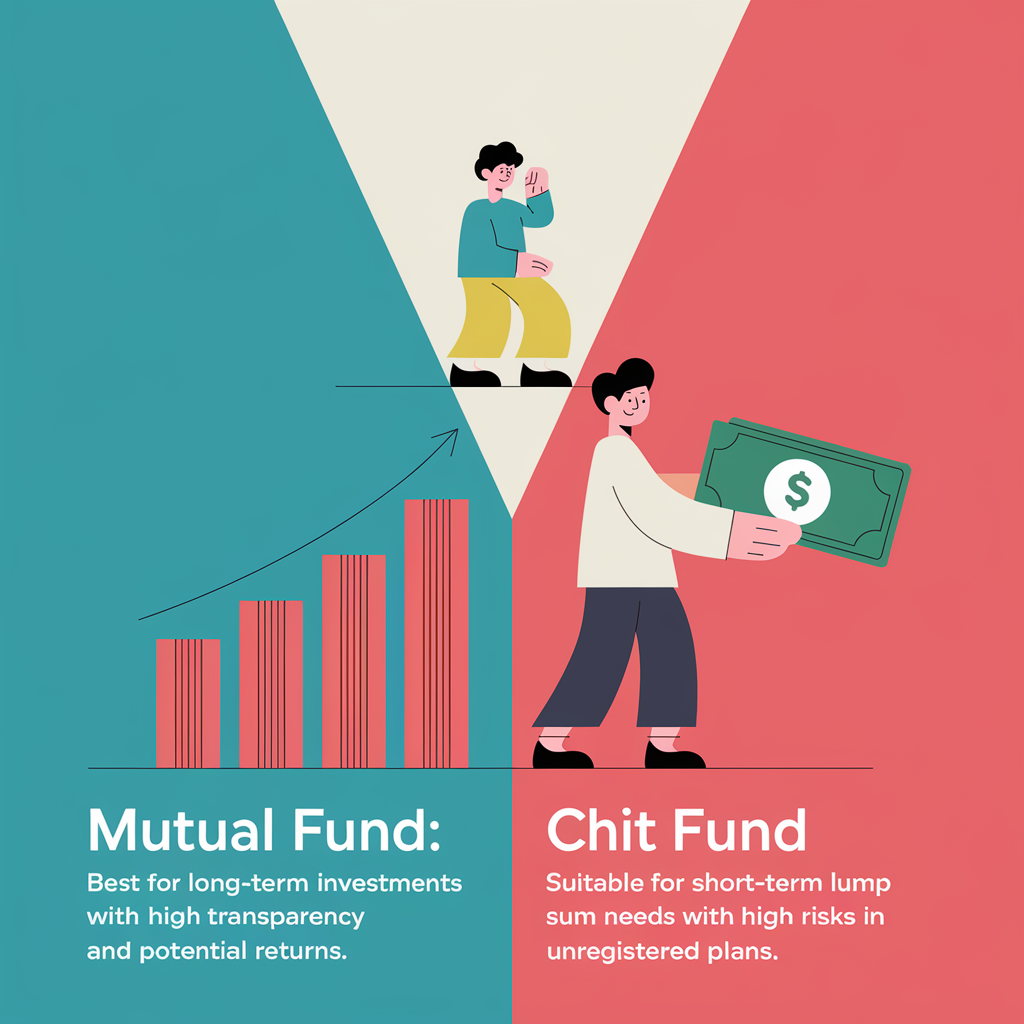

As we now know, mutual funds and chit funds serve different purposes. Investing in mutual funds can reap potential profits over the long run.

Mutual funds are highly regulated and monitored by the Securities and Exchange Board of India. This ensures a level of transparency and protection of the investor’s assets, which is often lacking in unregistered chit funds.

Moreover, mutual funds offer high liquidity, low risk, and potential returns upon maturity. When considering all the points mentioned in this article, it is critical to rule out that mutual fund plans are a better option for investors than chit funds.

On the other hand, chit funds are highly beneficial for those who are looking for a lump sum amount in a short period. Chit funds are deeply rooted in small towns in India. Small-time traders and labourers are deeply attached to chit-fund plans due to easier access to credit.

For investors who look for long-term wealth acquisition and financial freedom, a mutual fund offers a more structured and safer investment strategy.

In conclusion, understanding the difference between chit funds and mutual funds is highly crucial when considering investing in either of these funds.

Chit funds serve as a community-based savings and borrowing mechanism, which often involves higher risk if it is poorly managed. Chit funds offer the opportunity to acquire a lump sum amount in a short period.

Meanwhile, mutual funds offer a more structured approach and transparency for the investors.

Mutual funds are professionally managed investment vehicles that allow investors to place their money in a portfolio of stocks, securities, bonds, and other assets. Fund managers in mutual fund plans personally track and regulate the mutual fund portfolio based on market conditions. Mutual funds can generate potential income from the growth of corresponding stocks and other assets.

There are various types of chit funds and mutual fund plans, including organised chit funds, online chit funds, registered chit funds, unregistered chit funds, and equity mutual funds. Registered chit funds are more reliable due to government regulation, while unregistered chit funds are held among family members, close friends, or colleagues and have many loopholes and more risk.

Ultimately, for investors aiming for financial security and long-term growth, mutual funds stand out as the better choice, providing the transparency, liquidity, and potential returns that many seek in their investment journey.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Hashim Manikfan

Hashim Manikfan is a professional financial content writer with extensive experience in creating engaging and informative articles on a wide range of financial topics. With academic background in Communication and Journalism, Hashim has published numerous articles aimed at educating readers on essential financial principles. His work covers areas such as financial markets, investment strategies, economic trends, and more. His writing style ensures complex topics are accessible and interesting, making financial literacy attainable for a broad audience.