Do you also belong to the middle class, which is the majority of the population? Like every other middle-class family or individual, are you also wondering how to get out of the middle-class trap?

If you are, then you are at the right place.

Considering the growing concerns of the middle-class population, we have explored various factors that force individuals to struggle to live in a middle-class background and how can they survive to come out of middle class trap.

Middle class can be categorised into three, lower middle class, middle class, and upper middle class.

If you are in the upper middle class, then you wouldn’t be here because you would be already preparing yourself to boost your growth to become rich. Although, if you do not know how to, then this guide can be beneficial for you as well.

But if you are a lower middle class or an average middle class, then you have the burden and responsibilities to earn and provide more.

With rising living costs, you must be extremely disappointed with your struggle to meet goals.

Therefore, we have come up with unique strategies that can help anyone break out of the middle class. Following these strategies can help you save more and build financial growth.

Coming out of the middle-class trap may not happen instantly. It requires dedication, time, and effort. Becoming rich can be time-consuming, but it is worth all the effort.

Today, we are here to help you understand how exactly you can escape from the middle-class trap.

Understand and leverage the below-mentioned strategies in your financial plan to succeed in getting out of the middle class.

Being trapped in the middle class is very common. The constant struggle to come out of the middle-class trap can be stressful. This struggle often leads to the question: How can a middle-class person become rich?

While it seems challenging to achieve, it is not impossible. Careful planning, fostering a disciplined manner, and other strategic moves can help one break free from the middle class.

Breaking free from the middle class to become rich involves a combination of skills, financial habits, and flexible strategies that can move beyond maintaining a lifestyle to actively building wealth.

Here, we will discuss some of the unique strategies that can help middle-class individuals and families become rich in the long term.

Develop a comprehensive understanding of personal finance, investing, and strategic wealth-building methods to break free from the middle-class lifestyle. Master your budgeting skills by tracking income and expenses while reducing unwanted costs.

Identify potential income streams. Learn the fundamentals of investing to generate a solid wealth portfolio. Understand the basics of tax and explore tax-efficient ways to minimise taxes.

Always make room for improvement. Update your financial knowledge by learning new financial courses and staying updated with financial news. This will help to grab the money-making opportunities.

Create a budget that aligns with your financial goals, income, expenses, and other objectives. Use budgeting tools to regulate and track your plan. Identify areas where you can improve. Prioritise your needs over wants and follow a strategic budgeting rule like 50/30/20 for wealth building, which is 50% for needs, 30% for wants, and the remaining 20% for savings.

Automate your savings, investments, and debt payments. This will help you to secure the determined amount immediately after the payday. This approach cultivates a disciplined manner towards expense, savings, and investment. In case of debt, try paying high-interest debts immediately and avoid taking new debts.

Implement budget strategies like the zero-based budget approach, where all your income is assigned to a category, whether it is savings, expenses, or investments. Challenge yourself with no spending days or weeks where you only spend on necessities. Avoid lifestyle inflation and build financial flexibility to achieve financial milestones.

Increasing income streams is a powerful strategy to move beyond the middle class and become rich. Multiple income sources provide more financial flexibility, stability, and security. It also helps to accumulate wealth faster.

Start with maximising your primary income by seeking promotions, leveraging company benefits, achieving performance goals, and other benefits.

Then explore various income streams such as freelancing, investing, affiliate marketing, selling products, venture capital, and many others.

Identify your skills and choose income streams that align with your skills and passion.

Learn and understand your choice of income stream and diversify your sources of income by leveraging various skills and investing, making a combination of active and passive income streams.

Investment is an excellent way to passively. Establish investment goals into short, medium, and long-term goals. Diversify your investment options by investing in retirement accounts, stocks, mutual funds, bonds, and other securities. Explore real estate opportunities if you have a niche for property management.

Balance your investment in each of these categories to reduce the risk appetite. Make it a habit to consistently contribute to your investment securities selection in order to build a strong investment portfolio.

To ensure consistency, use systematic investment plans or automate your investments.

Analyse and track your investment goals. Manage and regulate your investment portfolio. Adjust the investments as per the market conditions. Make sure that your investments are in high-potential securities.

Hustle yourself beyond your job. Put your time and effort into other income streams to monetise earnings through them.

Whether it is freelancing, content creation, or developing digital products, maximising the efforts put into these side hustles can enhance revenue.

Leverage your skills in these side gigs to accelerate your financial journey. Escape from the middle class by generating potential revenue from multiple income streams.

Prioritise debt payment immediately on the day you receive a paycheck. Having more debts will put you in a loop of borrowing and repaying. As long as you are in this loop, you will not be able to break free from debts and contribute to savings.

Apply debt-paying strategies like debt snowball or debt avalanche to minimise the debts effectively. Avoid taking on new debts or loans. Having too many debts and loans can deplete your income rapidly.

Minimising debt while earning actively and passively through other income will help you diversify your earnings to become debt-free and also contribute to savings. In this way, you can generate huge wealth to get out of the middle class.

Constructing a solid emergency fund is a foundational step for financial freedom. Since emergency funds can be used for any purpose, it is crucial to determine their purpose and size and ensure that they are only used for specific emergencies.

Build an emergency fund by contributing to it on a monthly basis if you have a steady job. Or else, consider saving six to twelve months of expenses for an emergency fund.

Adjust your emergency funds on account of inflation or changes in living expenses. Use this emergency fund for big life events such as purchasing a home or having children, or use it for unprecedented events.

Owning a successful business can help pave the way out of the middle class. Businesses have high-income potential when compared with other professions.

If you have a certain skill or a solution to a demanding problem, you can consider doing business. However, business requires initial investments. Set realistic financial goals and ideas revolving around the business.

Identify the right type of business that aligns with your passion and financial goals. Choose a scalable business model that helps your growth. Evaluate the cost of funding and other requirements. Build a strong team and focus on customer requirements by conducting market research.

Develop a stable revenue stream within the business. If the business turns out to run well, then you can focus on it as it has greater income potential. Plan for long-term growth and scalability. With a successful business in your hand, you can easily upgrade from middle class to rich.

Middle-class individuals like to do things by themselves. If not, they feel as if they will lose their pride and dignity if they ask for help for common needs.

This practice can sometimes deplete the financial assets of an individual and force them to start back from square one.

Whereas, rich people do not hesitate to ask for financial help from their group of networks. Maximising your network will not only help with financial needs but can also lead to opportunities, partnerships, mentorships, investment deals, and others.

Shift your mindset from self-preserved to a growth and giving attitude focused on learning, sharing, and helping others. Leverage various platforms to connect with people with the right mindset. Attend webinars and networking events to boost your network and relationships.

Build authentic relationships with other individuals to leverage opportunities within the network. Having a strong community will help you to overcome unforeseen struggles.

The most important thing about escaping from the middle class to become rich is to foster disciplined saving and spending habits and always focus on the financial plan.

Achieving financial freedom takes time. Sticking to the long-term plan and consistently saving and investing in the long term will help generate wealth through the compound effect.

Staying disciplined and focused will help develop a structured approach and commitment leading to making informed financial decisions and taking control of our financial choices.

There are several reasons why people are stuck in the middle class. Different people encounter various factors that prevent them from becoming rich. Check out some of the crucial factors that contribute to staying in the middle class and learn how to avoid them.

Comfort over wealth: Not everyone in the modern world lives in substandard conditions. People in the middle class are too conservative about their wealth and remain level in their comfort zone.

Too much loan or debt: Middle-class individuals are frequently burdened with numerous loans or debts. Many people consider debt or loans to be inevitable and part of financial planning. People in the middle class think that debt is essential to getting by, but in reality, it is a never-ending cycle of earning and paying it back.

Avoiding risk-taking: The majority of middle-class individuals think that a good life is attained by hard work. They value hard work so much that they avoid taking chances or seizing new opportunities to improve their financial situation.

Lack of financial knowledge: Another important barrier to leaving the middle class is a lack of adequate financial knowledge. One way to overcome financial difficulties is to stay up-to-date on the latest financial concepts and innovative financial strategies.

Prevent lifestyle inflation: Do not exceed the spending with the growth of financial wealth through multiple income streams. Focus on financial goals and choose to live in the same way as before. This will help to achieve financial milestones quicker.

Finally, we have briefly addressed the most frequently asked question, “How to get out of the middle-class trap?” The journey to escaping the middle class can be challenging, but it is an achievable goal with proper financial planning, developing disciplined spending habits, and a strategic approach to managing and investing money.

Building a solid foundation for wealth generation can be accomplished through a unique strategic planning process. Developing astute budgeting strategies, increasing financial literacy, creating multiple income streams, investing, working outside of your primary job, avoiding excessive debt, leveraging emergency savings, doing business, and maximising networking and relationships can all help you avoid the middle class.

Diversifying your income into debt repayment and investment should be prioritised. A large amount of debt can deplete your financial resources. limiting your ability to save or invest. Repaying the debts can ease your financial condition and allow money to flow more into savings and investments.

Escaping out of the middle-class trap can be extremely tiring if you do not have essential financial knowledge, take risks, or have multiple loans. By following these unique strategies, anyone can attempt to come out of the middle-class trap.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Hashim Manikfan

Hashim Manikfan is a professional financial content writer with extensive experience in creating engaging and informative articles on a wide range of financial topics. With academic background in Communication and Journalism, Hashim has published numerous articles aimed at educating readers on essential financial principles. His work covers areas such as financial markets, investment strategies, economic trends, and more. His writing style ensures complex topics are accessible and interesting, making financial literacy attainable for a broad audience.

Indian investors are more attracted towards option trading than regular stock market intraday trading because of the high returns.

As a result, the Indian stock market has seen a sudden rise of active derivatives traders from less than 7 lakh in 2019 to over 45 lakh now.

As of now, more than 80% of the global options traders are from India, where 93% of retail traders in equity F&O suffered huge losses during FY 22 and FY 24. In contrast to the profits they traded, they caused more losses.

This sudden rise in option traders is due to several misconceptions, such as low risk-high reward or influencers promoting videos with the tag “options trading: 5000 to 1 lakh in an hour,” and many others.

In reality, option trading is highly rewarding, but it comes with high risk and is more complicated to understand than regular stock market investing or intraday trading.

Traders commonly use Nifty stocks and indices for option trading due to high liquidity.

Options trading involves understanding the landscape and dynamics of the derivative market as well as other fundamentals of options trading.

If you are a beginner and finding your way into becoming a successful options trader, then you should have a plan and strategy.

Due to various market factors, coming up with a rigid trading strategy may be quite difficult.

Therefore, we will be exploring some of the best option trading strategies in Nifty to help you identify which one is best for you.

It is impossible to single out just one or two of the best nifty option trading strategies.

Trading strategies are used in accordance with the conditions and trends of the market.

Thus, large losses may result from using the incorrect strategy at the wrong time.

To maximise potential returns, it is crucial to comprehend the fundamentals of various strategies and when to put them into practice.

Examine each of the strategies for nifty option trading and choose the one that works best for you.

Long call option trading strategy is a basic strategy used by options traders as a call option, where a buyer bets on an underlying stock to rise in value in the future and draws a contract that allows the buyer to purchase or sell an asset at a predetermined price in the future.

This contract is completed by setting the expiry date, strike price, and paying a premium to the seller.

If the price of the asset you purchased through a long call rises above the strike price on the predetermined date, you can expect to gain a profit.

However, if it doesn’t, then they will not exercise the right, ensuring potential losses don’t exceed the premium.

A long-call strategy should be exercised only if the market is in a bullish uptrend.

Only purchase in the long-call option if you believe that the asset price will rise to the predetermined price.

A short put is when option traders take put positions. A put option is where a buyer bets on an asset to lose its value in the future and has the right to sell the underlying asset in the future.

Similarly to the long call option, a contract is drafted by setting a strike price and expiry date and completed upon paying a premium.

In this case, if the price of the underlying asset falls below the strike price on the expiry date.

You can make a profit by selling the asset for the strike price at the expiration.

However, if the price remains above, then the option contract is worthless.

Long-put strategies are mainly used to hedge against long-call option contracts. It is implemented in case the underlying asset price heads towards a bearish position in the market.

A covered call is an options trading strategy where a trader holds a position in an underlying asset and sells the call option on the same asset to generate income.

This strategy is used by investors when they believe that the price will not rise sharply over the near term.

By taking a covered call, you can hold an underlying asset for the long term and also generate income through premiums of the sold call options.

The investors benefit most if the price stays below the option’s strike price as the option expires worthless and the investor gets to keep the stock and premium.

However, if the price rises and the buyer decides to exercise the option, then you are obligated to provide the share at the strike price.

Protective put is a risk management strategy for nifty option trading used by traders to limit potential losses.

A protective put is implemented when the trader thinks of a possible decline in an underlying asset after purchasing an asset.

This strategy is implemented by purchasing put options for the same underlying asset with a strike price below the price of the underlying asset to protect against losses.

If the stock price remains stable or increases, the contract remains null, and the investor only loses the minimum amount.

If the price declines, the value of the put option increases, resulting in more profits.

A bull call spread is a spread strategy that requires two or more option transactions.

This strategy is implemented by buying a call option and selling a call option simultaneously.

A bull call spread is done by buying a call option on an underlying asset at the same strike price as the asset’s price for a specific expiry time, which gives the right to purchase the asset at the strike rate before the expiration date.

At the same time, sell a call option on the same asset for a premium with the same expiration date but a higher price.

In the event of expiration, the trader has the right to exercise the options or close out the position by selling the long-call option and buying back the short-call option.

The trader would achieve maximum profit if the strike price rose above the underlying asset of the short-call option.

This strategy is used when a trader thinks that the price of an underlying asset will rise moderately in the future.

Bear call spread, also known as short call spread, is a conservative strategy used by traders when they expect the price of an asset to fall moderately.

A bear call spread is when a trader makes a short call option for a lower strike price than the asset’s price.

Simultaneously, the trader buys the same number of call options at a higher strike price with the same expiration.

The trader can achieve maximum profits if the underlying asset falls below the strike of the short-call option on the day of the expiration.

However, if the price does not fall, then the loss is limited to the net premium paid for the options.

Bear Put Spread is a type of option spread strategy used by traders when they expect an underlying asset price to decline in the future and hope to reduce the cost of holding the option trade.

As we know, spread strategies require two or more option trades.

A bear put spread strategy is completed when a trader takes a long position for a higher strike price than the asset’s price while selling the same number of put options on the same asset for a lower strike price with the same expiration.

Upon expiration, traders can earn huge profits by limiting the risks if the price falls by a limited amount between the trade date and expiration.

If the price falls more than the predicted amount, the trader loses the ability to make additional profits.

A bull put spread strategy involves purchasing and selling option traders.

A bull put strategy is used when an asset’s price is expected to rise moderately and profit from it.

This strategy involves selling one put option for a higher strike price and buying another with a lower strike price than the asset price and the same expiration date.

The trader aims for the stock price to close above the higher strike price of the short put option to get maximum profits from the difference in the premium costs of the two options.

Long straddle is an option strategy in which you buy call and put options on the same asset with the same strike price and expiration date.

This strategy is used when it is unclear whether the price of an asset will rise or fall.

It works by purchasing a call option with a higher strike price near its current price while purchasing a put option at the same strike price and expiration.

By doing so, you can profit from either the call option or the put option, as the profit from the winning option may outweigh the combined cost of the two options if it rises or falls dramatically.

A short straddle is the opposite of a long straddle. Selling one call option and the put option are the two short options that are used in this strategy.

This strategy is employed when an investor expects the price to remain stable and aims to make a profit from the premiums.

This strategy involves selling a call option and a put option at the same strike price, closer to the current stock price, with the expectation that the stock price will remain below the strike price of the short call option and above the strike price of the short put option.

If the stock price remains near the strike price, the option becomes worthless at expiration, and you can keep both the stocks and the premium.

If the stock price rises or falls significantly, either of these options may incur losses.

Intraday option trading is more time-limited and riskier than option trading due to its requirement to open and execute option trades on the same day.

The above-listed strategies can be implemented according to the market conditions in intraday trading, but quick decision-making, managing risks, and capitalising on rice movement requires a unique set of strategies to make consistent profits from intraday options trading.

A momentum strategy is a type of strategy that requires understanding certain important events, such as the latest news, announcements, quarterly and yearly reports, etc. of the asset you are trading on.

This strategy involves identifying the moment when the stock price is going to rise or fall. Intercepting such crucial information can help you identify the moment and make successful trades based on the information.

The breakout strategy is used when there is a possible breakout of price movement from its support and resistance.

It involves analysing breakout points of the stock price from their threshold using various technical indicators and other fundamental analyses.

If a stock price is expected to break the threshold and rise, it indicates purchasing the stocks.

The reversal strategy involves taking successful trades based on trend reversals. Trend reversals can be used to identify them using technical indicators like Bollinger bands, moving averages, and the relative strength index. the relative.

Analysing these technical indicators will help you identify possible trend reversals caused by various market factors.

Making successful call and put option trades based on the trend reversal can help you execute profitable option trades.

Intraday option trading is basically purchasing and selling options on the same day. Therefore, traders can make profits in small price movements occurring in a day.

The scalping strategy involves taking multiple trades a day. Take short or long options based on the market movement and close it immediately for smaller profits.

Increase the number of trades you make each day to generate multiple small profits that add up to a single large profit.

In conclusion, option trading strategies for nifty are available in many, each catering to different market conditions, risk management, and price movements.

It is essential to learn about these strategies before using them while option trading. Beginners can start with basic strategies like long call, long put, covered call, and protective put before going to the advanced strategies to capitalise on the modern market.

For intraday options traders, it is essential to understand certain key strategies like momentum strategy, breakout strategy, scalping, and others to make potential profits during intra-trading. Trading in options requires knowledge and a disciplined approach; if managed poorly, it can lead to potential losses.

Therefore, traders must cultivate a holistic approach and apply risk management decisions while options trading to avoid potential drawbacks and aim to build a consistently profitable approach using these strategies.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Hashim Manikfan

Hashim Manikfan is a professional financial content writer with extensive experience in creating engaging and informative articles on a wide range of financial topics. With academic background in Communication and Journalism, Hashim has published numerous articles aimed at educating readers on essential financial principles. His work covers areas such as financial markets, investment strategies, economic trends, and more. His writing style ensures complex topics are accessible and interesting, making financial literacy attainable for a broad audience.

India has become an emerging powerhouse for startups in the recent decade. The expanding economy has created more entrepreneurs, especially women. As of now, women comprise 14% of the total entrepreneurs in India.

Women entrepreneurs have played a pivotal role in shaping modern India because of their superior leadership abilities and higher levels of output. Women entrepreneurs are widely marketing their presence across various industries, fuelling the country’s economy by creating job opportunities and making significant contributions.

Despite the success as an emerging driving force for the country, women are frequently subjected to societal, patriarchal, and gender differences. These problems faced by women entrepreneurs in India have often suppressed many women from becoming great entrepreneurs.

Let’s take a look at some of the most common problems faced by women entrepreneurs in India.

Women’s success as entrepreneurs is often overshadowed by various struggles they face in and out of their work environment. Women face infinite difficulties on a day-to-day basis. Some of the most common challenges faced by businesswomen in India are given below:

Traditional Indian culture expects women to prioritise their family over business or career. This forces women to limit their time to focus on business. Women face pressures to meet societal expectations, which can directly limit their ambitions to become entrepreneurs.

Women are expected to fulfil domestic responsibilities, leaving them with less time and energy to contribute to their personal growth as entrepreneurs.

Some women entrepreneurs work for their families and the future not because they are expected to but because it is their responsibility.

Becoming a successful parent and an entrepreneur is struggling, as many times it can lead to stress, burnout, and reduced effort towards the business industry.

Balancing work and life is crucial for the progression and growth of the family and business.

Women all over India struggle to gain family support to kick-start their businesses or startups.

Often, women entrepreneurs are emotionally and financially discouraged by their families from pursuing their ambitions over responsibilities.

Emotional and financial support is crucial for anyone who is trying to excel in the business industry.

Without these two, women find it harder to navigate the complexities of the early stages of entrepreneurship.

Women entrepreneurs also face stereotyped attributes in the business industry.

Women entrepreneurs are often commonly found in businesses like beauty, fashion, or wellness.

This may be because people expect women to work in fields like these rather than in traditionally male-dominated fields like manufacturing and technology.

This might overshadow the integrity and diligence of a dedicated woman in a field dominated by men.

Women entrepreneurs frequently face unequal treatment in terms of lower pay, fewer promotions, limited leadership roles, lack of guidance, and many others.

The consistent practice of unequal ethics can often lead to discouragement in the pursuit of the role, resulting in resignation.

Unequal practices can also lead women not to choose their respective industries.

Becoming financially independent is a basic requirement for both men and women.

In our country, women follow the traditional custom of living off their spouse’s income, which often raises questions for personal use.

Meanwhile, women entrepreneurs also face similar situations when they want to start or expand their businesses.

Due to an early dependency on family members for financial decisions, women entrepreneurs may face delays in overcoming their struggles to become successful businesswomen.

Women-led businesses are constantly facing the integrity of the valuation, especially because they are managed by women.

Women entrepreneurs are constantly undervalued because of their age or level of ambition.

In the business world, women entrepreneurs who lack high-end networks frequently struggle more than businesswomen or businessmen who have a vast array of professional networks.

There is constant criticism directed at modern women, saying things like “You should be working in the kitchen instead of running businesses.”

Men and society at large have been known to make jokes about these trademark statements.

The absence of role models is a significant challenge faced by young women entrepreneurs in their respective fields.

A lack of role models often discourages female entrepreneurs, leading to a loss of confidence and motivation.

The lack of female role models in leadership roles also raises biases over the capabilities of women.

In the modern world, it is easy to connect with entrepreneurs all over the world.

Female entrepreneurs and workers frequently struggle with safety concerns as they are constantly subjected to multiple types of harassment.

The lack of authority to support females in the working industry has forced the victims to stay silent about the harassment, as many face threats from their respective abusers.

Fearing the consequences of unemployment and social backlash, many female entrepreneurs and workers undergo emotional trauma.

Wherever you look, whether it is healthcare, manufacturing, accounting, or others, women are easily trapped by abusers.

The lack of networking opportunities for women entrepreneurs often becomes an obstacle in their journey.

Finding mentors, building relationships, and accessing resources is quite challenging because of gender bias, an imbalance in work-life, and other responsibilities.

Gender bias and discrimination are some of the common challenges faced by businesswomen in various industries, especially male-dominated ones.

Gender biases arise in various circumstances, such as stereotypes about women’s abilities, low grades for women, workplace harassment, and many others.

These unforeseen circumstances directly affect the careers of women, leading to stress and anxiety.

The fear of being excluded from the industry often led them to cooperate with the situation.

This affects not only the career of the women but also the relevant company’s opportunities to expose the talents of women in the industry.

The complexities in legal and regulatory barriers often hinder the growth of businesswomen in various industries.

Legal issues include discriminatory policies against women, limited access to finances, and property challenges can be some of the many.

Battling these challenges often prevents them from participating in career-breaking opportunities, resulting in being stuck in one place with no career development due to multiple challenges.

These challenges can be improved by simplifying certain laws imposed against them.

In the male-dominant society, women do not get enough credits that they deserve.

This is one of the many reasons for the slow growth of women entrepreneurs in the past decades.

The habit of discrediting women’s work has led them to face struggles, making it hard for them to be taken seriously.

As a result, there is a reduction in the number of women in the workforce in various industries.

Financial literacy is crucial to strive for in the modern world, whether you are a man or woman.

In India, the majority of individuals do not support the idea of their daughter pursuing an education or being responsible for finance.

So many women grew up with zero knowledge of how to effectively handle their financial situation.

Due to a lack of financial literacy, they tend to struggle with managing finances. This eventually led them to miss out on several opportunities in various fields.

Moreover, even if they grab an opportunity, these women lack enough knowledge to recognise and capitalise on profitable opportunities.

Therefore, this can hinder the growth of women entrepreneurs significantly.

Resources such as funding, networking, education, technologies, and others are pivotal in a successful journey.

Lack of access to these resources can blind any entrepreneur. In the case of a woman, a lack of any of the basic resources for the development of her business can put her business greatly in danger.

Unlike men, women struggle to borrow and gather resources due to poorer networking contacts than men.

So challenges like these can be a burden to the success of women.

Our culture is notorious for making snap judgements about other people. The criticisms of women can become so baseless that the majority of them are not even accurate.

On the other hand, constantly being judged by society makes one doubt themselves and encourages them to avoid criticism. In order to avoid criticism, a large number of people—men and women alike—submit to the social patriarchy.

This fear of being judged grows over time and can manifest in various ways, including fear of failure, fear of criticism, fear of rejection, and fear of not being taken seriously.

Women become so fixated on this issue that they strive for success. Nevertheless, failure is a necessary part of success.

When they face failure, they lose self-esteem because of this fear, which causes stress and anxiety.

Thus, this challenge can put your career in danger if not addressed appropriately.

It can be difficult to thrive in the business sector if you do not understand modern technology, as most things are now digital.

Individuals can create personal and commercial brands on the internet using social media.

But too much exposure to it can lead to online harassment and cyberattacks.

The efficient use of computerised and marketing tools is critical for businesses.

Furthermore, everyone must keep up with the rapidly evolving technologies; failing to do so could impede their ability to advance in their careers.

It can be extremely difficult for people who are not tech-savvy to succeed in the business sector.

Social isolation can be a threat to your mental health and career.

Single women who are working remotely or in industries with limited networking opportunities can have a difficult time finding work-life balance.

Gender bias perspectives further make it difficult for women to participate in key business circles.

Moreover, running a business can be stressful, leading to burnout or decreasing confidence due to a lack of emotional support.

In the business world, there are no gender differences when it comes to competition.

However, there is a huge difference when it comes to benefits and challenges.

Women are compelled to struggle with numerous challenges, such as accessing capital, gender bias arguments, limited networking, support, and many others.

Women entrepreneurs find it struggling to achieve these when men can conveniently resolve any problem they face.

The absence of women leadership in policy-making bodies limits their ability to influence policies and regulations in their favour, which directly impacts lots of women-led businesses.

Several policies, such as tax implications, funding programs, and regulatory frameworks, are designed without considering the stance of a working woman.

Moreover, this pressing concern also leads to unequal distribution of resources and opportunities, where men are more favoured than women. Women struggle to scale their businesses without proper resources.

Addressing the challenges requires a multi-planned approach aimed at fostering a supportive environment for growth and success while balancing the work calamity.

The key efforts involve addressing the core problems and implementing the appropriate solutions to overcome the obstacle. The following are some of the key measures to address these pressing concerns.

Self-confidence is the root energy to deal with any challenges. Losing confidence can lead to self-doubt and emotional vulnerability, resulting in making impulsive decisions.

Engage in mentorship programs that focus on self-perception to improve confidence.

Advanced courses based on current technology and business principles, marketing, and providing robust training for relevant subjects can help women entrepreneurs improve their business knowledge and equip them with the necessary skills to navigate the business environment.

Explore various financial platforms like FinQuo Versity to enhance your financial knowledge.

Engage families and communities in discussion of the importance of women entrepreneurs.

Conduct community programs and educate society on the shared responsibilities and the need to become financially independent for everyone.

Encourage government and private financial institutions to generate women-centric financial schemes to support women entrepreneurs’ businesses.

Promoting specific grants and subsidies for women can reduce the financial barriers.

Organise campaigns challenging the stereotypic norms regarding women in business ventures in society.

Highlight the importance of women-led business enterprises and foster an optimistic perspective about women doing business in society.

Make equal work policies for men and women to promote gender equality in business.

Encourage hiring practices based on the skill to remove biases. Provide pay and benefits irrespective of gender and create flexible work policies for both genders regarding parental leave and work options.

Establish a zero-tolerance harassment policy with clear instructions and consequences.

Provide safe channels to address any harassment to a higher authority.

Offer support and counseling services and protection to encourage women to report harassment without fear.

In conclusion, the problems faced by women entrepreneurs in India are significant and pose a threat to their success in the competitive business world. Their problems range from gender inequality, work-life balance, societal expectations, lack of family support, financial struggles, and many others.

Above all, the lack of women in the policy-making bodies is one of the main reasons why other challenges continue to emerge even after so many years. Women’s leadership roles can bring changes to these challenges if addressed correctly.

Despite these obstacles, women entrepreneurs have managed to increase their presence in the business industry, contributing to societal and economic progress.

However, addressing these problems by conducting educational programs, promoting support campaigns, providing financial access, encouraging the implementation of equal policies, and protecting women from workplace harassment can help encourage women entrepreneurs to freely and confidently establish their skills and efforts for the business. These positive measures can help women showcase their excellence in business.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Hashim Manikfan

Hashim Manikfan is a professional financial content writer with extensive experience in creating engaging and informative articles on a wide range of financial topics. With academic background in Communication and Journalism, Hashim has published numerous articles aimed at educating readers on essential financial principles. His work covers areas such as financial markets, investment strategies, economic trends, and more. His writing style ensures complex topics are accessible and interesting, making financial literacy attainable for a broad audience.

Saving from your salary is an extremely difficult practice when you earn a low income. It is difficult for people in the middle class and those making less than ₹15,000 per month to save money and budget their expenses appropriately. Many often wonder how to save money from salary every month? That’s why we are here to help you.

Saving requires planning and the right mindset. For those earning a high-end income, saving a portion of their salary may be easy, while the remaining salary can be used for expenses. However, irregular spending and poor budget planning can disrupt the savings progress.

In this article, we will discover the importance of saving, how to save money sustainably, how much you need to save every month, and many other details. Keep reading to find out the unique saving strategy that will help you master your saving skills in the future.

Saving is the traditional way of building wealth by contributing a part of your income at regular intervals. Over time, it grows into a large amount. Saving is crucial when planning for the future.

Saving is highly important as it offers financial freedom, security and stability for individuals. All the individuals who are earning must practice saving to achieve long-term success.

Having a savings plan reduces so many financial difficulties, especially from debt or relying on credits, which can bring down financial stress and promote overall well-being.

Consistently saving money every month develops financial discipline and cultivates better spending habits. Maintaining a successful savings plan offers retirement opportunities.

The earlier you start to save, the more you save money from salary every month and have time to grow your money and take off early retirement.

Saving money from income requires planning, creating a proper budget, and having the right mindset. With a clear understanding and a holistic approach to regular contribution by lowering lifestyle expenses, anyone can develop a strong foundation for saving habits.

Savings allow the money to grow with interest due to its compounding effect. Saving for a longer time can help grow a gigantic amount. Banks and financial institutions offer different saving schemes, where individuals are free to choose from.

But before that, it is important to lay the foundation prior to starting a savings plan. Below you will find a basic plan that may help you start saving for the future.

List out your financial goals, whether it is purchasing a car, home, or planning for retirement. Be realistic about your goals and estimate how much it would cost to achieve the goals. Define your goals into short-term, mid-term, and long-term.

Short-term goals can be building an emergency fund for 3 to 6 months or saving some money for vacation. It could be anything that involves saving money for a short-term period to achieve specific goals.

Saving for a child’s education and purchasing a car or home can be considered as a midterm goal. Mid-term financial goals require saving for 5–15 years to achieve them.

Long-term savings commonly align with planning for retirement and wealth accumulation. When you start planning for retirement, you might need to start saving for a long period.

Analyse your financial condition by creating a solid budget plan. Use computerised tools to list out your financial records, including your expenses, total income, assets, liabilities, and debt. This will help you to evaluate your financial health and identify room for improvement.

Create a detailed budget by listing all your sources of income, expenses, and debt. Categorise your expenses and debts and record how much you need to spend. Stick to the plan and make necessary adjustments in the future.

Utilise the 50/30/20 rule to allocate your income into needs, expenses, and debt or savings. Allocate 50% of your income to your needs, 30% of your income to other expenses, and 20% of your income to debt/savings. Practising this rule will help to make a disciplined approach to spending habits.

Identify all your debts, including loans and credit card debts. Make sure to allocate funds for debt payment while creating a budget; prioritise paying debt first using the debt snowball method or the debt avalanche method.

Make paying off debts ahead of time a top priority. This will help you to avoid any penalty charges. Always remember to pay off your debts before the due date to avoid using more money for debt repayment.

The debt snowball method is the process of paying the smallest debt at first and using the extra money to apply to the next smallest debt. This method helps to boost morale when a debt is cleared. It helps people to stay positive and focus on the next debt.

Managing debt is highly important when saving. Too much debt can prevent you from saving. Avoid taking on more debts or using credits while managing existing debts to prevent your situation from worsening.

Cutting expenses is another pivotal factor when it comes to savings. However, you cannot completely cut off all the expenses as you require essential needs for living.

So, categorise your expenses into basic needs, non-essential needs, and lifestyle changes. This will help you to monitor how your money is being spent on expenses. Essential and non-essential needs can be minimised by using effective cost-cutting measures given below:

Use public transport during travelling to your work or other areas. Avoid using a personal vehicle when you are travelling alone. This approach will help you save maintenance costs, fuel costs, and parking fees.

Travelling on public transport may not save a huge amount daily. But over a long period, saving a small amount of ₹100 a day for a year can turn into a big amount.

Reduce the frequency of dining out in expensive restaurants and cafes. Prioritise cooking habits to save funds from expensive dining. Eating homely-cooked healthy foods can also help you prevent unwanted healthcare costs.

Reduce the amount of energy you use by not using lights during the day. Remember to turn off the electricity when not in use. By adopting these simple practices, you can lower your electricity expenses. Also, use water efficiently.

Avoid spending too much on entertainment, such as going to the movies, cultural events, and music festivals. Review your subscriptions on streaming platforms and cancel any unnecessary subscriptions.

Consider home gatherings for family together, party nights, or game nights. This will help you to cut the unwanted costs. Explore entertainment options that don’t burn your pockets.

When purchasing groceries and other daily goods, avoid purchasing these daily goods more than you require. Purchasing more than your requirement often causes the daily goods to expire, resulting in a loss of money.

Purchase things as per the financial budget and avoid emotional purchasing. Try spending a smaller amount of money on things that are used for a shorter period, such as clothes and fashion products.

This will help to reduce unnecessary spending and unwanted things at home, enhancing your savings portfolio. Less consumption of things also means less waste, leading to small action toward a sustainable environment.

Tobacco and alcohol usage can negatively impact your savings plan. If you are consuming tobacco or drinking, try to quit as soon as possible. Consumption of alcohol and tobacco can be addictive, leading to huge financial losses over time.

The money being saved from smoking and drinking can be used either for paying off the debts or directly towards savings. This way, you can achieve financial goals faster than you expected.

Moreover, alcohol and tobacco can dampen your health conditions, leading to various health issues. By avoiding these, you can reduce your healthcare costs.

Set up automatic transfers from your income account to your savings account. This strategy can enable you to consistently save a portion of your income every month. This strategy doesn’t require manual transfers and saves effort and time.

Setting up automatic savings contributes to regular savings and promotes a disinclined saving habit. This process can help you gradually accumulate savings over time.

Regularly monitor and track your expenses for effective money management. Keeping a record of your expenses will help you to understand where your money goes and which areas you can cut unwanted costs. Analysing the expenses will help you make an informed decision in the future.

Use the same tool used to create the budget plan to record and analyse. Note down every transaction and make necessary adjustments if required. Always prioritise listing the expenses for effective money management and future references.

Investing is not a form of saving because it involves risks. But investing by making informed decisions can help boost your wealth to become free from financial burden.

Investing can help enhance your financial health in the future. Profits gained from your investments can be used to achieve your financial goals.

Successful investment opportunities will help you achieve your financial goals faster and accumulate the profits into savings. You can choose to invest to improve your savings plan. There are various investment vehicles available. Below, you can find some of the investment options.

Purchasing shares of the company to get a profit upon selling the same strategies is called stock investment. Stock investment involves risks and significant potential.

Understanding the fundamentals and principles of the stock market is necessary to begin investing in the stock market. Learn various stock market strategies and risk management decisions. Employ a set of strategies you like and start investing in the stocks.

Making informed decisions while investing in the stock market can help you gain huge profits as the market moves. These profits can then be used for achieving financial goals or maintaining the savings plan.

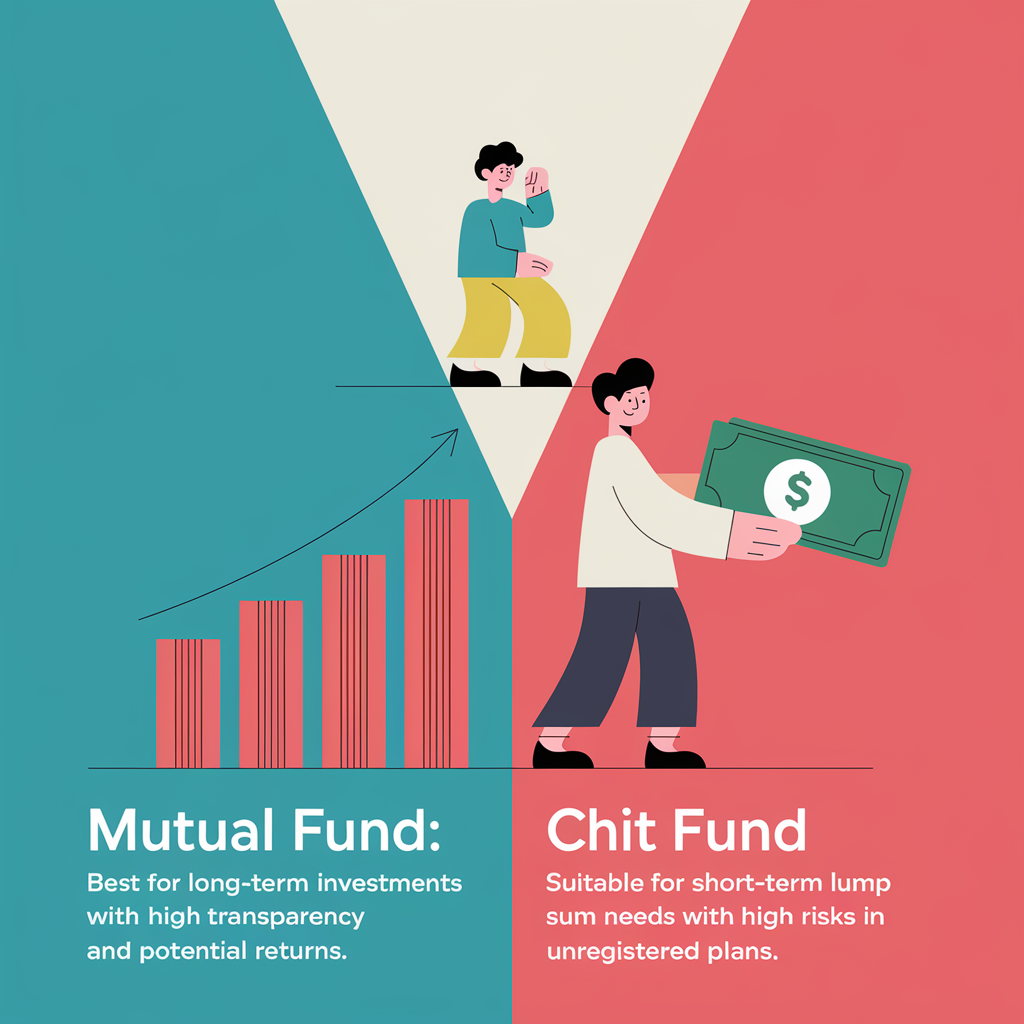

If you do not have the time or ability to learn the concepts of stock marketing, then you can choose to invest in mutual funds.

Mutual funds are a group of stocks where investors pool their money to invest. These pools of funds are managed by fund managers, who purchase and sell stocks that have high yields. Fund managers will manage your investment portfolio for a small fee.

Start investing in mutual funds through a SIP account, where you will be automatically investing a predetermined amount to the mutual funds every month.

Investing in a mutual fund does not require any time or effort, as your funds will be regularly monitored and tracked by fund managers. Fund managers analyse the market conditions and move your funds to yield socks for better profits.

A public provident fund is a retirement investment option that allows investors to invest up to ₹1.5 lakh annually. The Public Provident Fund offers high returns with minimal risk. It helps you systematically save enough for long-term goals.

You can open a public provident fund account in financial institutions, banks or post offices. This investment option has the potential to accumulate a large amount of profit in the long run.

Real estate investment is the process of purchasing properties and lands to lease out as rent or to sell later when the market rises.

You can purchase a property in a small locality for a cheaper price and use it as a means of income by renting out the property. In addition, real estate in India has boomed over the years. Considering the historical data, the property prices are expected to rise every year. This might help you sell the property for a profit in the future.

A Unit Linked Insurance Plan is a financial investment option that offers dual benefits of investment and life insurance. This plan will allow you to invest in equity, bonds, and other securities based on the risk preference for the long term.

You need to pay a regular premium where a portion of the premium is allocated to investment funds and the remaining position is allocated to the life insurance plan. This plan secures financial stability as well as healthcare costs.

ULIP allows flexibility in withdrawals, meaning that you can withdraw partial funds before turning maturity. Upon maturity, the accumulated value of the investment is paid out.

As a beginner, you might make some common mistakes that can drag down your saving progress. There are several mistakes that common individuals make while starting a saving plan. Some of these mistakes are given below:

Failure to have a solid plan for proper planning and financial goals can jeopardise a savings plan. Without these principles, you may not have the desired savings balance in your account.

Borrowing too much credit or loans can keep you from saving anything. Pay off your debts as quickly as possible to free up funds for savings.

Poor management of savings, such as breaking out the savings before they become anything, can prevent you from accumulating wealth in the future.

Making records of the expenses and savings can make you desire more and lead to spending without planning. Maintaining records will help you remind yourself about expenses and control your emotions.

Never ignore the tax payments. Tax payments are handled by the government. Avoiding tax payments may lead to trouble with the IRS and may lead to severe penalties in the long run.

As now you have read this article, we can assure you that you find the right answer to how to save money from your salary every month.

In conclusion, the importance of saving cannot be understated, as it offers financial flexibility, security and stability for individuals. At the same time, saving for future financial goals can be extremely difficult considering the high expenses.

But saving money from your salary is not an impossible task. It can be easily done by following a solid plan and prioritising the importance of saving. Having a clear idea of what you want to achieve makes it easier to create a budget-saving plan. Regular contributions and consistent tracking down expenses are key to maintaining a savings plan.

Utilising the unique 50/30/20 will help to make consistent contributions to the savings plan where individuals are only required to put 20% of their salary into the savings. In addition, lowering unwanted expenses, reaping customer benefits, repaying debts, and automating savings can further improve your savings plan.

Following this well-structured and solid plan will help you keep track and make regular savings to achieve your financial goals.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Ibnu Jala

Ibnu Jala is an experienced professional in the financial markets of India and the Middle East, renowned for his trading expertise and mentorship. His passion for neuroscience drives his research, blending finance and science seamlessly. With a Bachelor’s in Law from India and an MBA from the UK, Ibnu Jala has a diverse academic background. In addition to being a seasoned investor and serial entrepreneur, he currently leads FinQuo Versity as its CEO.

Money is more important than love when it comes to leading a financially stable life or achieving financial independence in relationships. As the saying goes, money pays bills, which turns out to be true.

As commodity and asset prices rise on a daily basis, people are more concerned with achieving financial stability than with finding love.

Money is a financial instrument that has monetary value to purchase goods and services based on needs. Earning a sufficient amount of money can fulfil certain needs, such as buying a house or achieving other financial objectives.

But there is no guarantee having plenty of money can fulfil your happiness.

Modern-day peers prioritise money over love to achieve financially stable living conditions at first, as money is essential to meet daily needs, so it is crucial to build a financially secure life before planning to get married or start living together.

Living with a partner has its own psychological and monetary benefits. Suppose both of you are earning. Then your expenses can be reduced with the help of contributions from your partner.

However, if only one of you is working, having a high-paying job will help you maintain your standard of living and achieve a financially secure future.

At times, not having enough money can lead to disagreements between partners, which can often disrupt trust and emotional connection. Therefore, it is crucial to be in control of yourself and avoid getting overshadowed by money.

Continue reading to learn why money is necessary for thriving in a standard of living in relationships.

Money is frequently viewed in the modern world as the source of financial security and stability, which involves being debt-free and having enough money to cover expenses, emergencies, and retirement.

Everyone should strive for financial independence because it allows them to live freely and make wise decisions without having to worry about money.

Having enough money allows people to live their lives on their terms by pursuing their passions without relying on anyone for financial support.

Financial difficulties can often compromise relationships and personal values. To provide financial stability to relationships, it is crucial to achieve financial independence.

Financial success is often measured by one’s ability to accumulate wealth, as it opens doors for new opportunities such as investing in personal growth, changing careers, and starting a business.

Money not only protects financial expectations, but it also promotes financial stability and success, giving individuals a sense of empowerment to shape their own futures and maintain control over their lives.

The psychological impact of money goes both ways, positively and negatively, respectively, on the financial status of an individual.

Achieving financial stability and success often brings security and control over monetary decisions, leading to reduced stress and anxiety about daily expenses and future uncertainties

On the other hand, lack of financial security can lead to feelings of inadequacy, stress, anxiety, and depression. The pressure to achieve financial success can also fuel anxiety, chronic stress, and obsession. This could also negatively affect your values.

Additionally, the pursuit of money may lead to emotional detachment from loved ones, leading to loneliness or dissatisfaction despite having financial success.

Money can indeed improve psychological well-being depending on how it is managed. At the same time, making impulsive decisions on money can harm mental and emotional health.

Achieving a balance between financial goals and emotional factors is crucial for positive psychological well-being

Money has a significant impact on the dynamics that foster and shape long-term stability in relationships. Financial compatibility is as important as emotional connection. Money is important than love when it comes to building a financial foundation.

Financial responsibilities, including bills, savings, and investments, are frequently shared by couples in modern relationships.

However, differences in income levels may influence decision-making. This often leads to disagreements and alienation.

Despite individual financial independence being valued in modern relationships, managing money in relationships requires mutual interest, open communication, and clear agreements.

Prioritising financial stability before major commitments is highly important for the growth of the relationship. Shared financial goals and objectives can help build a financially secure future for couples.

Achieving a financially secure future in relationships reflects the growing importance of money in sustaining healthy and lasting relationships.

At the same time, lack of financial success can lead to financial stress, leading to conflicts over debt, spending habits, and financial priorities. These can eventually strain relationships.

Money is not the ultimate source of happiness in relationships. Because relationships are built on emotional connection, trust, and mutual respect.

Money can enhance the financial status of relationships by achieving financial security and stability, which eliminates financial worries regarding daily expenses, managing debts, or future planning.

A financially secure and stable relationship can create a more profound environment where partners can focus on shared experiences and other values.

Financial security and stability cannot only bring long-lasting joy or satisfaction without emotional connection and other shared values.

Money can indeed improve the quality of living in a relationship without worrying about financial constraints. But it is not the ultimate source of happiness in relationships

Finding happiness between love and money in relationships is a real struggle for many. The key is to find a balance between love and money.

Money provides financial security, stability, and the freedom to pursue opportunities. While love cultivates emotional fulfilment, connection, and support.

If you have plenty of money but no love, you may struggle to find fulfilment or satisfaction. On the other hand, if you have love but no money, the constant desire to earn more money causes stress and anxiety, which can have a direct impact on relationships.

As previously stated, finding a balance between money and love is essential for relationship fulfilment and satisfaction. It is always necessary to set money and love apart because these two components offer distinct values.

Money is more important than love in modern society, as it provides financial security and stability. In the modern day, people try to accumulate financial stability and security before finding love to support a quality standard of living.

Becoming financially independent is crucial to building a quality life without having financial constraints. This allows individuals to promote stability and empowerment to shape their present and future according to their terms.

Money can have a positive and negative impact on your emotions depending on how it is accumulated and managed.

Having enough money can help alleviate financial stress and anxiety about daily expenses and future uncertainties.

Lack of money fuels the desire to create more, which can lead to stress and undervaluation of other things such as relationships and love.

Financial security and emotional attachment are critical in today’s relationships.

While money can provide financial security and stability in relationships, mutual respect, love, and trust serve as the foundation for those relationships.

Money cannot provide the ultimate joy of a relationship. Finding the balance between money and love is the key to fulfilment and satisfaction.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Hashim Manikfan

Hashim Manikfan is a professional financial content writer with extensive experience in creating engaging and informative articles on a wide range of financial topics. With academic background in Communication and Journalism, Hashim has published numerous articles aimed at educating readers on essential financial principles. His work covers areas such as financial markets, investment strategies, economic trends, and more. His writing style ensures complex topics are accessible and interesting, making financial literacy attainable for a broad audience.

If you ask me, “Is money the most important thing in life?” My answer would be no. Different individuals have various perspectives on money. Money is indeed necessary to meet the basic expenses. But money alone may not bring you fulfilment in life. Earning money is extremely important for striving in the modern world. At the same time, understanding the basic things of money, such as saving for the future and achieving financial freedom, should always be a priority.

Money plays a significant role as a driving force in life. The importance of funds varies from individual to individual. For many who struggle from their early childhood, money could become everything they need in life. For others who grew up with money, it can be secondary, while relationships, experiences, and personal fulfilment are more important.

Modern living thrives with money as it promises security, comfort, education, housing, healthcare, and many others. Simply earning money cannot buy you happiness. Utilising the money to achieve life goals and new experiences is more important than simply earning and saving the money.

Real happiness comes when you find the balance between life and money. Finding the balance can be challenging, as money can often overshadow the things that truly matter in life. Let’s find out the impact of money on different things and how exactly to balance money with other life principles to become truly happy.

The simple purpose of money in society is to be used as a medium of exchange between individuals and entities. Money encompasses a value that can be traded with goods and services for the respective value.

If you want to purchase anything, you need money to make it possible. This makes me wonder how money became the most important thing in life.

The role of money is so important that it is the backbone of a nation’s economy. Everything we do in the modern world involves money. Therefore, the availability of money determines the economic activity of society as well as the standard of living.

The ability to avail healthcare, education, housing, daily goods, financial freedom, and many others highly relies on money. So, earning money is a crucial priority for individuals living in the modern world.

However, individuals need to use the money properly so that it creates a positive effect on the entire community. Misusing money for personal gain can have a negative influence on society as well as the economy of the nation.

Money plays a vital role in surviving in the modern world. Beyond survival, it provides several benefits to ease the way of living. Here are some of the ways money can help improve your lifestyle

One major contributor to tension and stress is a lack of money. It frequently has negative effects on one’s physical and mental well-being. Creating the right kind of wealth can ease financial strains and encourage stability.

Money can help achieve financial independence by making choices that align with your financial goals and values. Creating multiple income sources helps people to achieve their career paths, travel, or enjoy a leisurely life without trading labour for money.

Since the modern world is centred on money, earning is necessary, and education is crucial for that purpose. Though it cannot purchase education, money can assist in obtaining the necessary resources for knowledge acquisition.

Money may not bring complete fulfilment, but it can enhance the standard of living. It helps to access comfortable homes, better healthcare, consume healthy food, and improve overall well-being.

Having enough money allows you to take advantage of additional opportunities by lending money, investing, or trying something different. These pursuits can ease financial strain and contribute to a stable financial future.

Money is important thing in life to meet the quality standard of living. However, relying solely on money may have a negative impact on other personal values. Developing personal values and meeting quality living standards may lead to ultimate happiness.

The psychological and emotional impact of money on individuals has taken a roller coaster ride where more than thousands of individuals, particularly businessmen, are highly influenced by money. While some individuals have a disciplined manner when dealing with money.

According to studies, as people become more successful, they lose empathy and compassion. This often leads to changes in their priorities and how they see their life after success. However, some people are different.

Hence, we will be exploring both the negative and positive influences money can have psychologically and emotionally on individuals.

Money plays a Important role in shaping life. When it is utilised sustainably, it can have a positive influence on the overall lifestyle. Some of the positive impacts of money are given below:

A fixed income can provide a stable lifestyle for meeting daily expenses and planning for the future. Earning enough money to support the family is essential for financial security.

Money opens the door to new opportunities. Investing in real estate, the stock market, or starting a business highly relies on money. Sustainable investment in various investments fosters a solid investment portfolio and increases earning potential.

Since the advancement of technology in healthcare, medical expenses are rising day by day. Hence, earning potential income is crucial to meet better healthcare facilities. Enhanced medical care may guarantee better health.

A stable income can be used to learn new skills and experiences, which can help with personal development and career advancement. Pursuing a passionate skill can lead to personal fulfilment and promote a balanced life.

Lack of money or desire to earn more money every day can lead to a negative impact on the whole psychological well-being.

The pressure of handling earnings and meeting daily expenses can be extremely stressful. Constant worrying about maintaining or growing wealth leads to financial worries.

Individuals with limited financial resources experience fear of losing everything all at once. Stress due to financial worries can negatively impact your overall lifestyle.

Money can often influence our emotions, such as greed and envy, especially if we have a lot of money.

This could often lead to a major conflict in personal relationships due to disagreements about savings, expenditures, or financial priorities among spouses, family members, or business partners, causing bitter relationships.

Obsession with money can cause a lot of problems. The greed to have more money is a never-ending personality trait that could impact personal values such as prioritising wealth over personal relationships, experiences, and personal fulfilment. As a result, individuals may engage in unethical behaviour such as dishonesty to gain financial advantage

Priorities and financial objectives are frequently distorted by the desire to amass greater wealth. Wealth can create a sense of blindness, resulting in diverting focus from the real purpose.

The amount of money required for a happy life varies depending on a person’s lifestyle choices and financial goals. The key to happiness is accumulating a large amount of wealth and striking a balance between financial security and meeting one’s needs, experiences, health, and relationships. A steady income can bring happiness, but it depends on how people spend their money.

It is true that higher income correlates with better lifestyle choices and access to health care, resulting in a higher quality of life. Happiness can only increase with income if other life principles like relationships, health, and personal needs are balanced. Otherwise, beyond a certain income level, money does not bring happiness.

In conclusion, money does play an important role in shaping modern life by serving as a powerful tool for meeting basic needs, achieving financial security, and unlocking opportunities for growth and education. Quality education, healthcare, and a decent standard of living all require money.

While money can improve your overall quality of life, relying solely on it for happiness can lead to stress and a loss of self-esteem.

Earning a sufficient amount of money is necessary for meeting financial needs, especially for those from a poor financial background. However, money may not become an important factor for people who have grown up in a wealthy environment.

Therefore, the value of money reflects differently for individuals. While for some money is the only thing that matters in life, for others personal relationships, commitments, and other life values dominate over money.

So it is critical to strike a balance between money and other life values, such as relationships, experiences, and health. Identifying the thin line between money and personal values is the key to happiness

Money can influence your mind in both psychological and emotional ways. Greed, envy, and desire can often blind people to the importance of earning money. People frequently go crazy over money.

Emotions such as greed can influence a person to engage in unethical behaviour for financial gain, resulting in regret and a loss of self-esteem.

Cultivating disciplined spending habits can help you overcome negative emotions and gain control of finances. Practising these habits allows you to resist temptations and make more informed financial decisions.

No amount of money can buy ultimate happiness. According to studies, wealthy people frequently lose control of their lives as a result of a lack of happiness brought on by an abundance of money. As a result, cultivating meaningful relationships and enjoying life’s small pleasures while earning a steady income is the best way to achieve happiness over time.

Disclaimer: The information provided in this blog is for educational and informational purposes only and should not be considered as financial or investment advice. Stock market investments are subject to market risks, and past performance is not indicative of future results. Readers are encouraged to do their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher are not liable for any financial losses or damages incurred from following the information provided in this blog.

Ibnu Jala